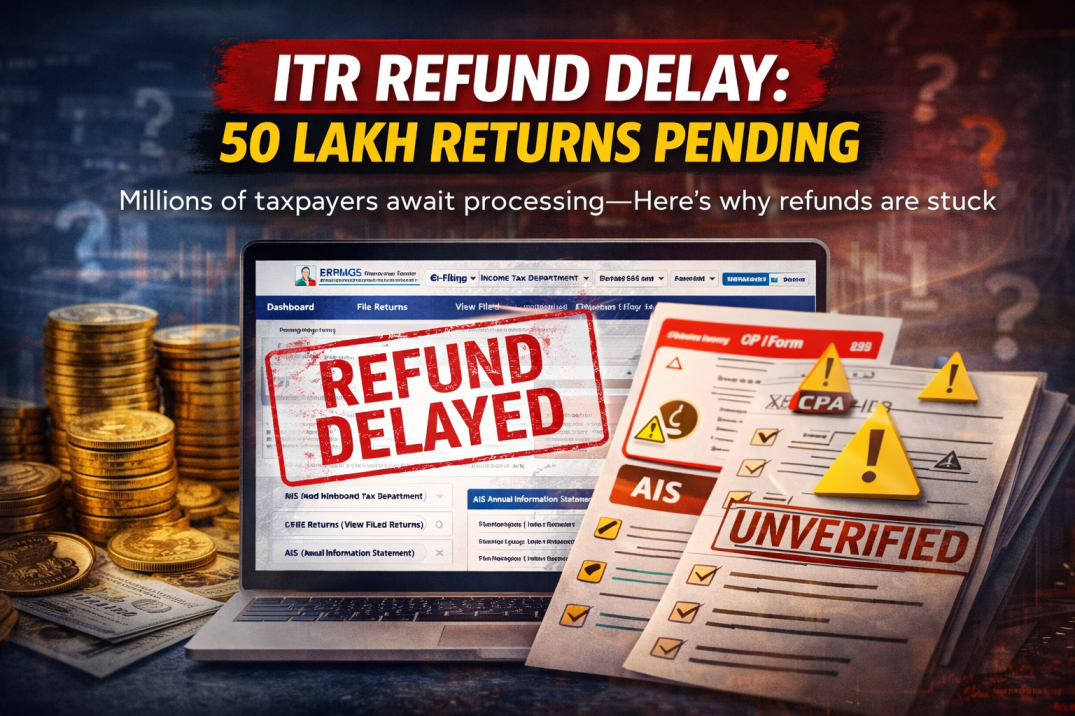

ITR Refund Delay: Why 50 Lakh Taxpayers Are Waiting

ITR Refunds Delay: Over 50 Lakh Taxpayers Await Processing — Here’s Why Refunds Are Stuck

More than 50 lakh taxpayers are still waiting for their income tax refunds, and honestly, it’s starting to test everyone’s patience. Plenty of folks filed their returns on time, did everything by the book, and yet, here they are—still checking their bank accounts and wondering what’s taking so long.

So, what’s actually causing all these holdups?

Most of the delays come down to technical glitches or paperwork not lining up. The Income Tax Department has pointed out a few big reasons:

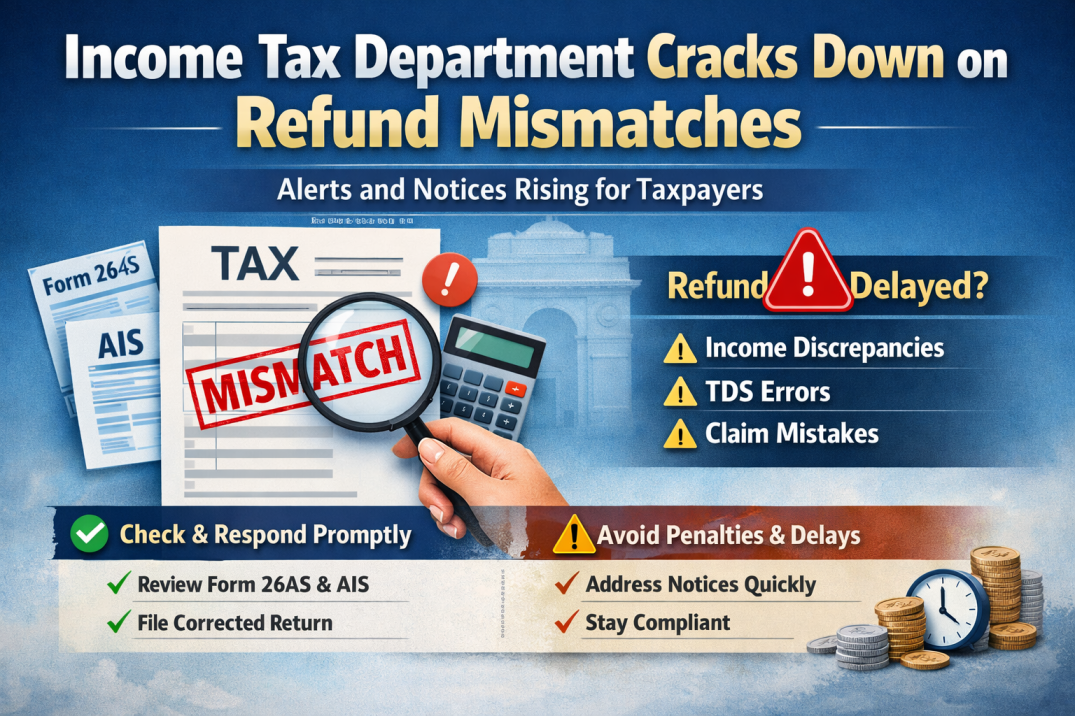

1. Mismatched Information in AIS and Form 26AS

A lot of returns show differences between what people reported and what’s listed in the Annual Information Statement (AIS) or Form 26AS. Sometimes the numbers don’t match up, even by a little, and that’s enough to send your refund into a manual review pile.

2. Pending E-Verification

Some people filed their returns but didn’t finish the e-verification step on time. If you skip this, your refund just sits there, waiting for you to complete the process.

3. Bank Account Problems

Wrong IFSC codes, inactive accounts, or not pre-validating your bank info on the tax portal can all slow things down. If the system can’t confirm your bank details, your refund stays stuck.

4. More Scrutiny and Heavy System Traffic

There’s been a jump in the number of returns this year, which means the system’s busier than ever. On top of that, the tax department has started checking claims more closely to stop fraud, which adds to the backlog.

What Should You Do Now?

If you’re still waiting for your refund, don’t just sit tight—take action:

– Log in to the Income Tax e-Filing Portal.

– Look up your refund status under ‘View Filed Returns’.

– Check your AIS and Form 26AS for any mismatches.

– Make sure your bank account is pre-validated.

– If the tax department asks for any clarification, reply right away.

When Will the Refunds Come Through?

Officials say refunds stuck because of mismatches or pending verifications will get released once you fix the issues. If you update your details quickly, you can expect things to move faster—hopefully in the next few weeks.

Bottom Line

Waiting for a tax refund isn’t fun, but if you stay on top of your paperwork and keep your info updated, you can speed things up. Double-check your income details, make sure your bank info is right, and respond to any notices fast. That’s your best shot at avoiding more delays.

Facing an ITR refund delay? Stay informed with our latest tax updates and expert guidance. Follow us now for real-time income tax news.