RBI Policy Update: Repo Rate Reduced to 5.25%

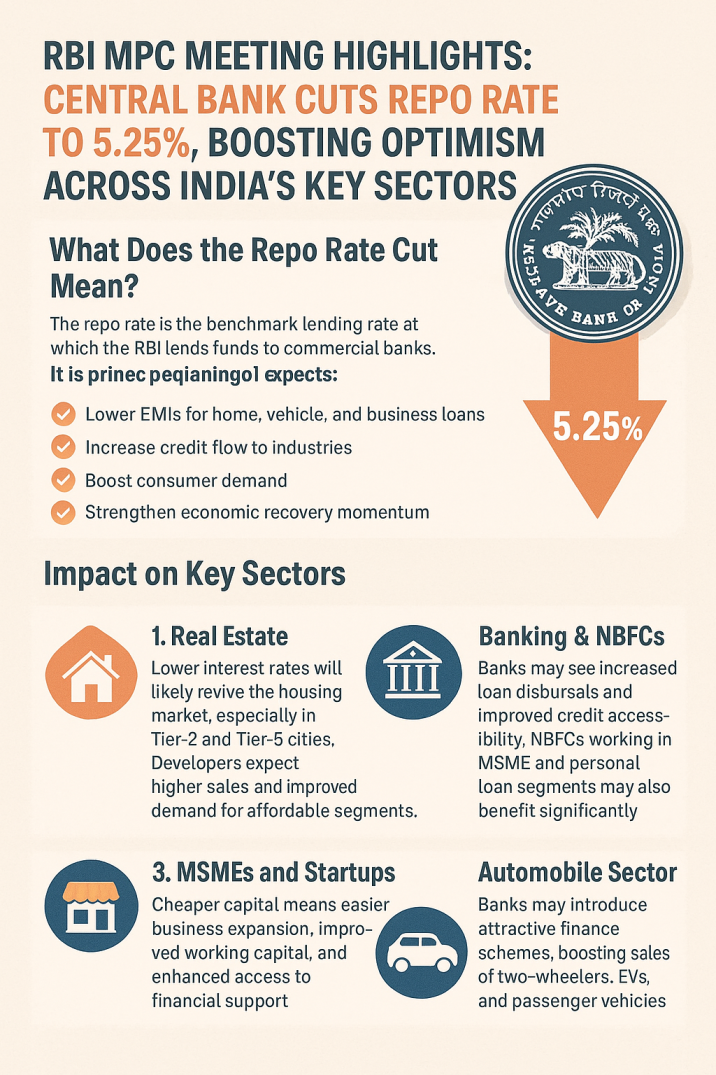

RBI MPC Meeting Highlights: Central Bank Cuts Repo Rate to 5.25%, Boosting Optimism Across India’s Key Sectors

Big news from the Reserve Bank of India: the Monetary Policy Committee just cut the repo rate to 5.25%. It’s a big move, especially after months of playing it safe. Right away, you could feel a jolt of optimism across the country—real estate, banking, MSMEs, the auto sector, and even everyday shoppers are all buzzing.

Why now? Inflation’s finally cooling off, and things feel steadier around the world. The RBI wants to kickstart growth, make it easier for people and businesses to get cash, and help the recovery pick up speed.

So, what does a repo rate cut actually mean?

Basically, that’s the rate at which the RBI lends money to commercial banks. When the RBI lowers it, banks can borrow money more cheaply, which usually means lower interest rates for all kinds of loans.

Here’s what changes:

– EMIs for homes, cars, and businesses drop.

– Companies find it easier to get loans.

– People are more likely to spend and invest.

– The recovery gets a real shot in the arm.

Let’s talk about who’s set to gain the most:

1. Real Estate

Home loan rates just got better, which could fire up sales—especially in smaller cities. Builders are already hoping for a jump in demand for affordable homes.

2. Banks & NBFCs

Banks will likely hand out more loans, and people should find it easier to get credit. Non-bank lenders, especially those serving MSMEs and personal borrowers, look set for a boost too.

3. MSMEs and Startups

Cheaper loans mean small businesses and startups can grow, keep their operations running smoothly, and get more support from lenders.

4. Auto Sector

Expect banks to roll out tempting financing deals. That’s good news for anyone eyeing a two-wheeler, EV, or family car.

5. Stock Market and Investments

Stocks jumped right after the announcement, especially in finance, real estate, and consumer sectors.

All in all,

The RBI’s move shows real confidence in India’s growth story. By making loans cheaper, the government’s betting on stronger consumption and more investment—exactly what the economy needs for long-term stability.

Economists are already saying—if inflation stays calm, we could see more rate cuts in the months ahead.

What should you do now if you’re a borrower or investor?

– Take another look at your existing loans.

– Think about refinancing.

– Consider locking in long-term investments.

– Keep an eye on what the MPC does next.

Bottom line:

Cutting the repo rate to 5.25% is a bold step to speed up growth. With so many sectors ready to move, this could be a turning point for India’s economy over the next year.

✨ Ready to Stay Ahead in Finance and Economy Updates?

👉 Subscribe to our newsletter for daily business insights, budget analysis, stock market updates, and economic forecasts.

📩 Join now and never miss a policy change that affects your money!