GST 2.0: What It Means for You and Your Wallet

If you’ve ever bought groceries, shopped for gadgets, or filled up your car, you’ve indirectly dealt with GST. But now, India has rolled out GST 2.0, and it’s a big change—designed to make taxes simpler, life a little cheaper, and the economy a bit stronger.

So, what exactly is GST 2.0?

Think of GST 2.0 as the “upgrade” of India’s tax system. Instead of juggling multiple tax rates, we now have a simpler structure: essentials cost less, luxury items cost more, and everyone can understand what they’re actually paying. It’s like cleaning up your closet—everything is neat, organized, and easier to manage.

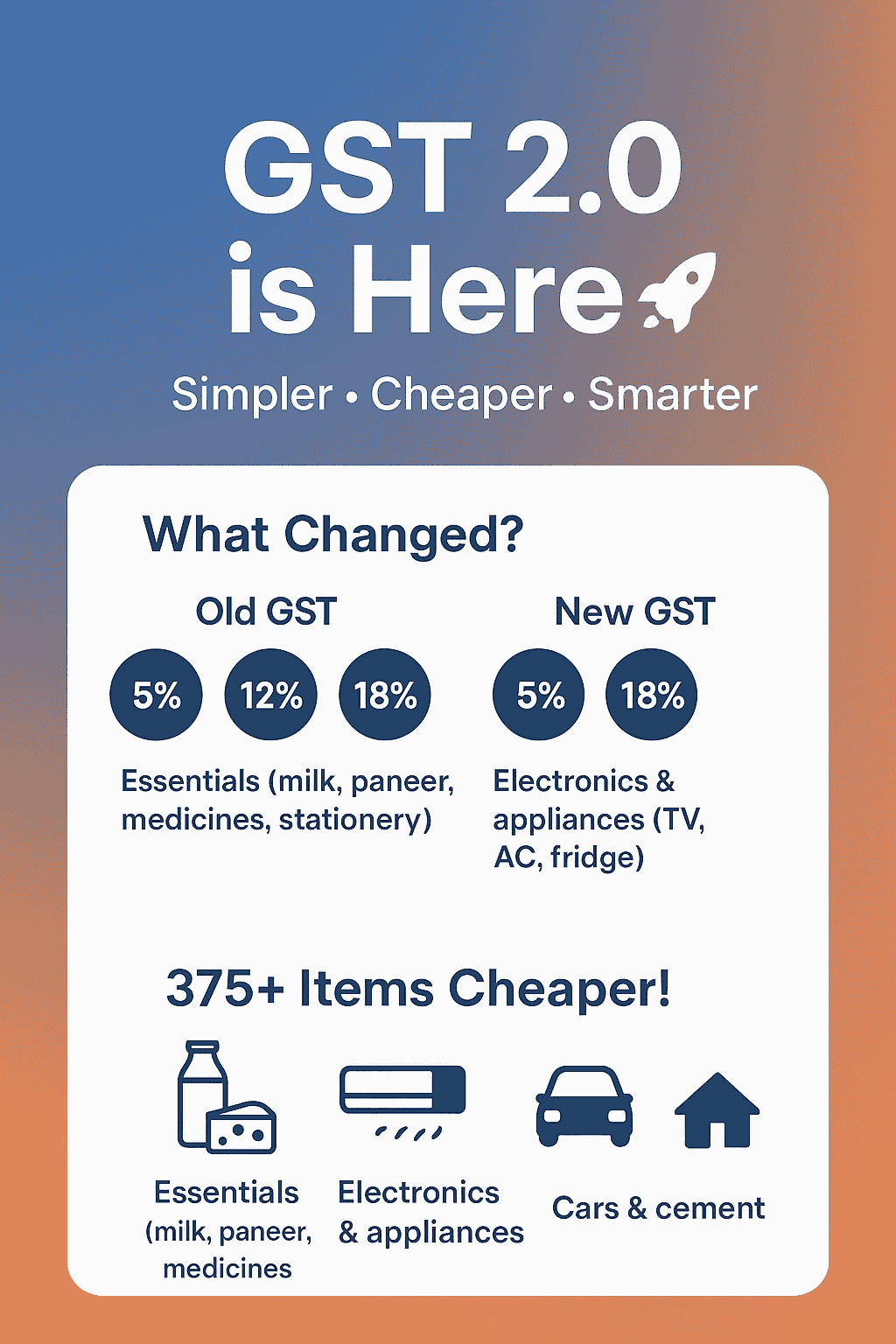

Important Changes You Should Be Aware Of :-

Simpler Slabs: While the majority of goods, including electronics and services, are subject to 18% GST, necessities, such as groceries and everyday items, are now subject to 5% GST.

Basics like milk, paneer, and necessary medications are tax-free. Good news for your pocketbook: there is no GST.

Luxury & Sin Goods: Tobacco, aerated beverages, and expensive cars are subject to a 40% plus cess tax. A splurge will likely result in greater taxation.

What Impact Does This Have on You?

For Customers: Prices for commonplace goods like snacks, ghee, gadgets, and compact autos will be marginally reduced. The cost of shopping has slightly decreased!

For Businesses: It’s simpler to submit taxes and stay in legal compliance. A greater dedication to development implies less paperwork.

About the Economy: GST 2.0 seeks to balance the system, promoting spending while preserving government revenue by making necessities less expensive and luxury goods more taxed.

Examples from Real Life

Purchasing a TV or air conditioner? Instead of paying a higher old slab of GST, you are now paying 18%.

Buying groceries, such as milk, paneer, and snacks? 5% or no GST makes things much more affordable.

Are you thinking about a luxury vehicle or carbonated beverages?

Yes, that is the point at which the higher 40% tax is applied.

The Point of View of the Government

Referred to as the “GST Tax Utsav,” Prime Minister Modi highlights how the reform affects small businesses, middle-class families, and farmers. It is intended to facilitate business operations and make daily living a little easier.

The bottom line :-

Making taxes intelligible and everyday living affordable is the goal of GST 2.0, which is more than just a law or a statistic. For consumers, that means cheaper staples. It makes compliance easier for enterprises. It means more growth and spending for the economy.

Advice: Pay attention to the most recent GST rates, particularly if you own a small business or are making significant purchases. You may avoid headaches and save money by being aware of GST 2.0.

What are your thoughts on GST 2.0? Will it make business easier and consumption more affordable?